New Generation

Market Segmentation

SEGMENTATION THAT LINKS TO BEHAVIORS. FINALLY. (A 2 minute video.)

(Be sure to run the video in fullscreen by clicking on the icon below).

SEGMENTATION THAT LINKS TO BEHAVIORS. IT'S TIME. (VIDEO)

THE LIMITATIONS OF CONVENTIONAL SEGMENTATION

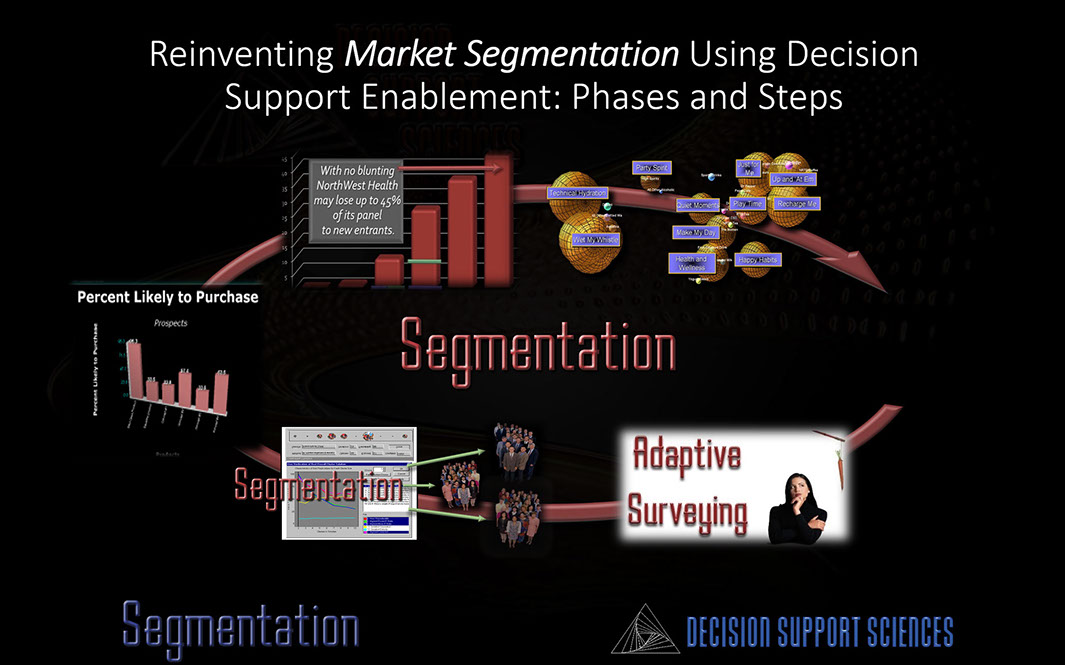

MARKET SEGMENTATION USING DECISION SUPPORT ENABLEMENT (DSE)

THE PHASES and STEPS

OF A DSE SEGMENTATION ENGAGEMENT

KEY BENEFITS

EXAMPLE CLIENTS

WHITEPAPER (PDF)

CONTACT / QUESTIONS

VIDEO

CENTER

CONSULTING

PLATFORMS

SOFTWARE

SOLUTIONS BY INDUSTRY

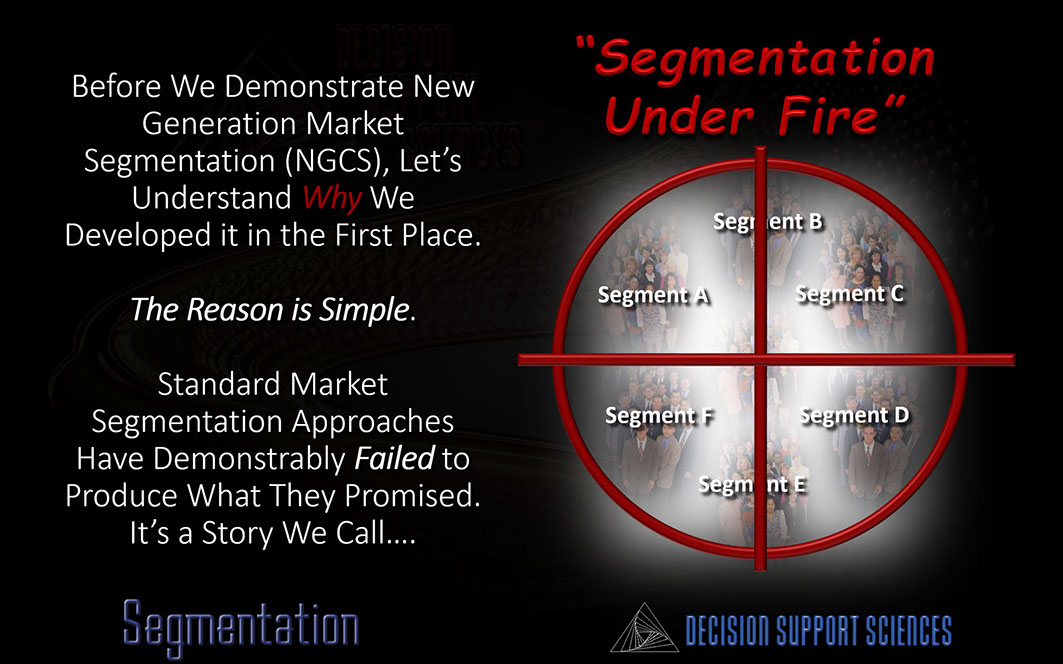

THE LIMITATIONS OF CONVENTIONAL SEGMENTATION APPROACHES

Why Do Conventional Market Segmentation (CMS) Engagements Produce Sub-Optimal Segments?

-

The market segmentation landscape is littered with costly, failed approaches to segmentation:

- Both academics and practitioners have demonstrated that the standard scalar (e.g. 1-5 scale) or categorical (pick-any) data fails to link optimally to behavior.

- Worse yet, although conventional segmentation sounds compelling: (e.g. "Relators", "Loyal Joes", etc.) these segments do NOT map 1:1 to real-world customers in your datamart.

- Worst of all, over 95% of CMS engagements don't produce operational change - because they don't link to the premier platform for sales and service - your retail datamart (or EMR system).

-

The

data

collected is incomplete or inadequate. The measurement system for

segmentation :

- Misses important drivers of segmentation.

- Doesn't reproduce the purchase decision - so it misses real-world trade-offs people make that reveal their underlying need states.

- Doesn't recognize that the average customer has only 3-4 key drivers.

- Doesn't recognize that across segments most markets have only 25 key drivers - not hundreds.

-

The Segmentation Decision Support System

( SegDSS) doesn't produce optimal segments

because it:

- Doesn't use a rich enough measurement model (See above.)

- Doesn't use a rich enough set of algorithms to develop the segments.

- Doesn't perform deep validation (mathematical cage wrestling) to validate the segments.

- Doesn't use automated expert systems in recommending the optimal segmentation.

- Doesn't visualize the optimal segmentation.

-

The

consulting

firm :

- Imagines that they are your equity partner - and charges you that way.

- Gives you only the fish (the segments) not the the fishing pole (the segmentation system.)

REINVENTING SEGMENTATION USING DECISION SUPPORT ENABLEMENT (DSE)

Our Decision Support Enabled Segmentation (DSE) practice provides the following improvements over traditional segmentation approaches:

-

The Measurement System for DSE Segmentation

:

- Uses a rich, seven dimension measurement model (NOT JUST attitudes on a 1-5 scale.)

- While retaining important measures from prior systematics (especially categorical behaviors.)

- Captures new, important missing drivers of behavior by reproducing the purchase decision.

- Captures needs-based drivers for each customer by using a transform of the importance (utility) of each key product attribute in the market.

-

The Segmentation Decision Support System

( SegDSS)

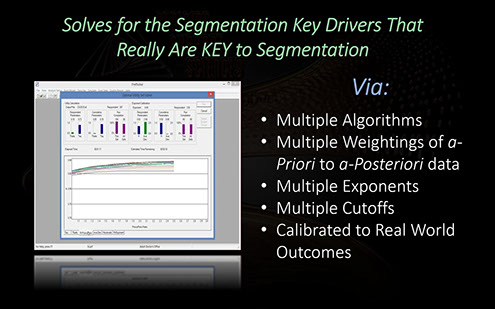

produces optimal segments because it:

- Uses the industry's broadest set of segmentation algorithms (cluster/Q-factor/factor.)

- Performs deep validation (mathematical cage wrestling) to test the different ways a segmentation can be termed "optimal."

- Uses an embedded expert system to recommend the optimal final segments.

- Visualizes the optimal segmentation: so that the strategists can understand the that segmentation both parametrically and visually.

-

The DSE Segmentation Engagement:

- Costs one-half to one-third that of traditional segmentation engagements.

- Delivers the fishing pole (the Segmentation System) not just the fish (the segments.)

Net-net? Our DSE Segmentation engagements produce tighter, more separated market segments at a far lower cost. That's enablement.

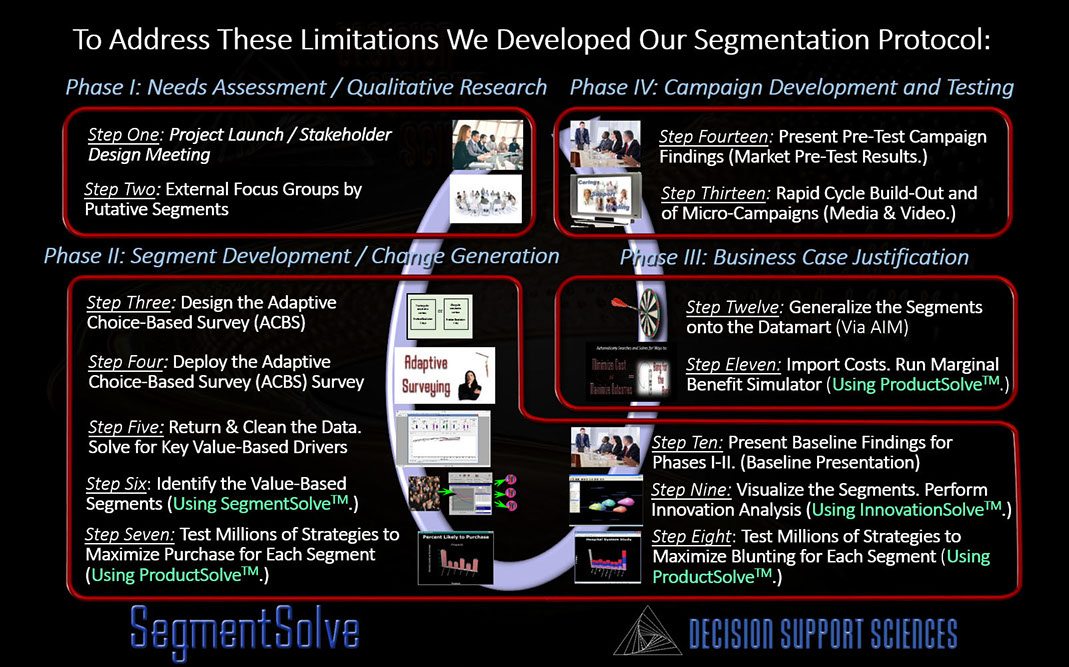

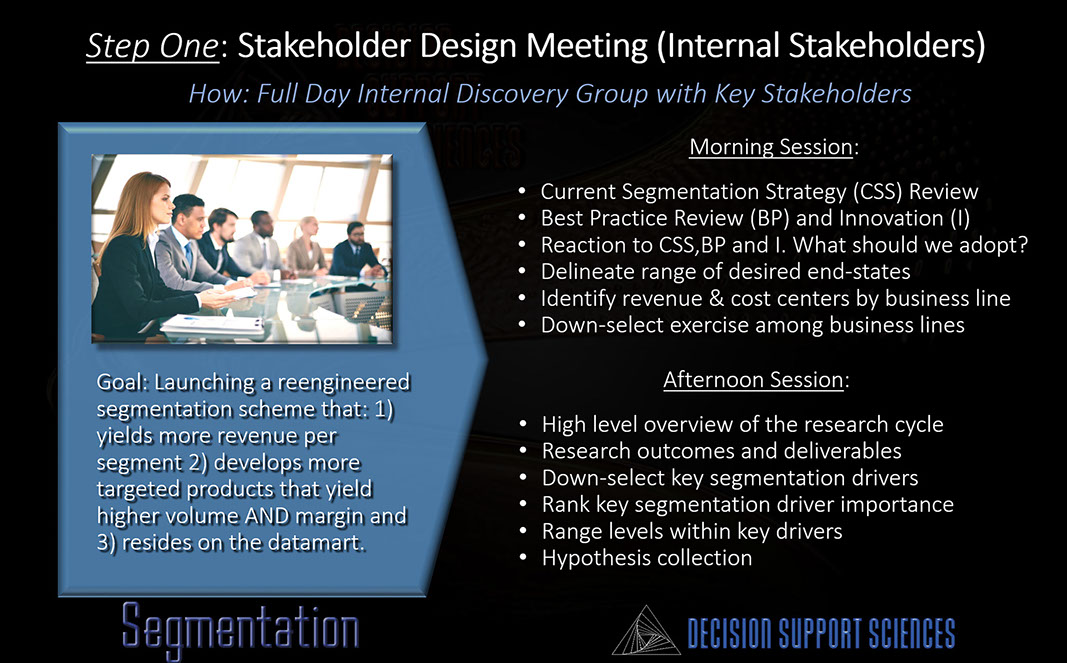

PHASES AND STEPS OF A DSE MARKET SEGMENTATION ENGAGEMENT

(Click on the first icon below to start the slide show.)

KEY BENEFITS (Place your pointer over the benefits to see the short description.)

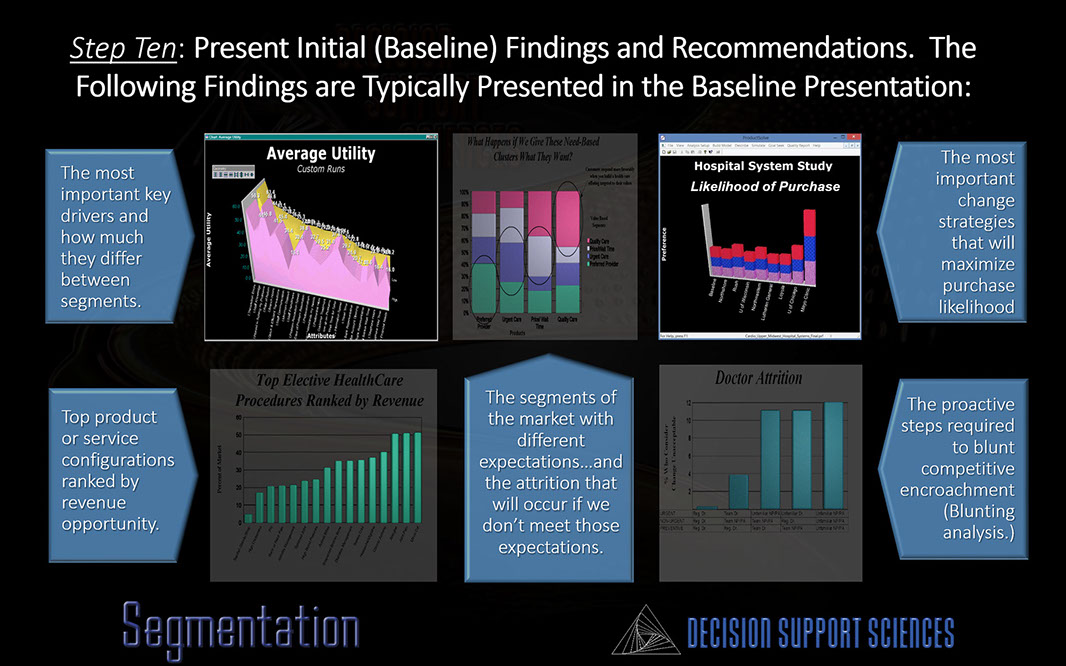

There is no pretty way to say it. Market Segmentation initiatives demonstrably fail most of the time. The problem? Conventional segmentation: 1) tends to be strategic and not tactical 2) doesn't provide specific product strategies that increase profit 3) doesn't tell us what specific products and services we need to build for each customer to produce real-world outcomes (sales, retention, profit.) 4) doesn't reside on the data mart...where tactics get deployed.

The only way to develop an operational segmentation scheme is to 1) be already "in the ballpark" with a reduced set of key drivers that link to real-world outcomes and 2) measure those key drivers accurately (see the next benefit). Our New Generation Values-Based Market Segmentation (NGVBMS) approach does both.

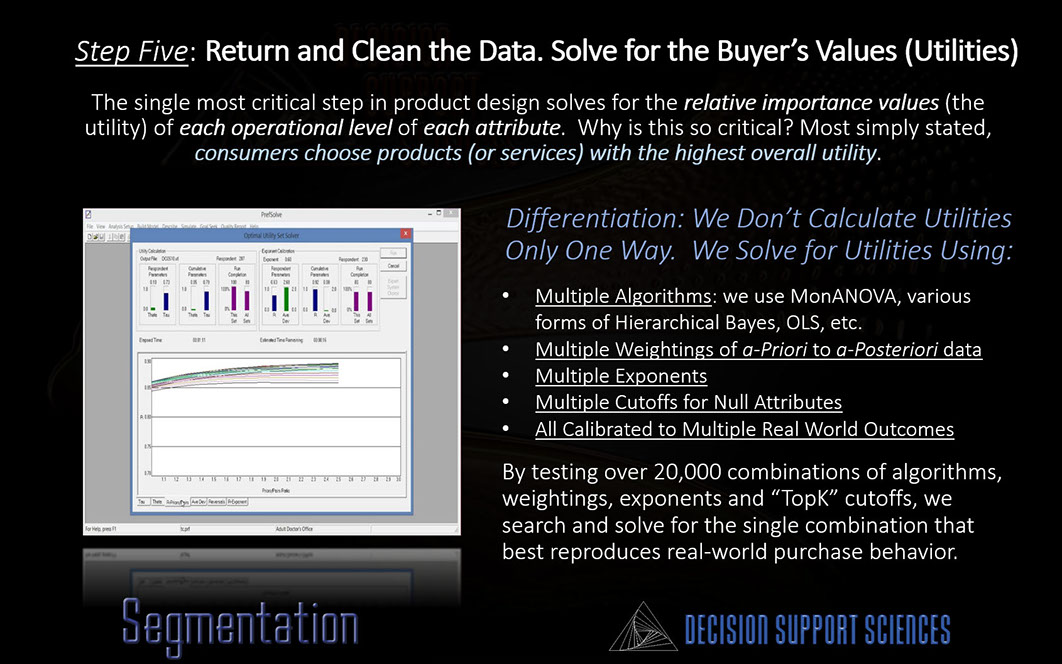

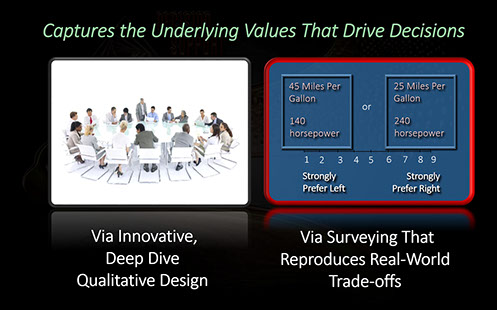

Research has now made it clear that simply asking customers what they like does NOT cut it. In contrast, our segmentation protocol requires the consumer to make the same TRADE-OFFS in survey that they make in real life. In this way consumers reveal their TRUE values. Next, of course, one must accurately SOLVE for those values. We pioneered our advanced utility calculation approach 20 years ago...and it still leads the industry in accuracy.

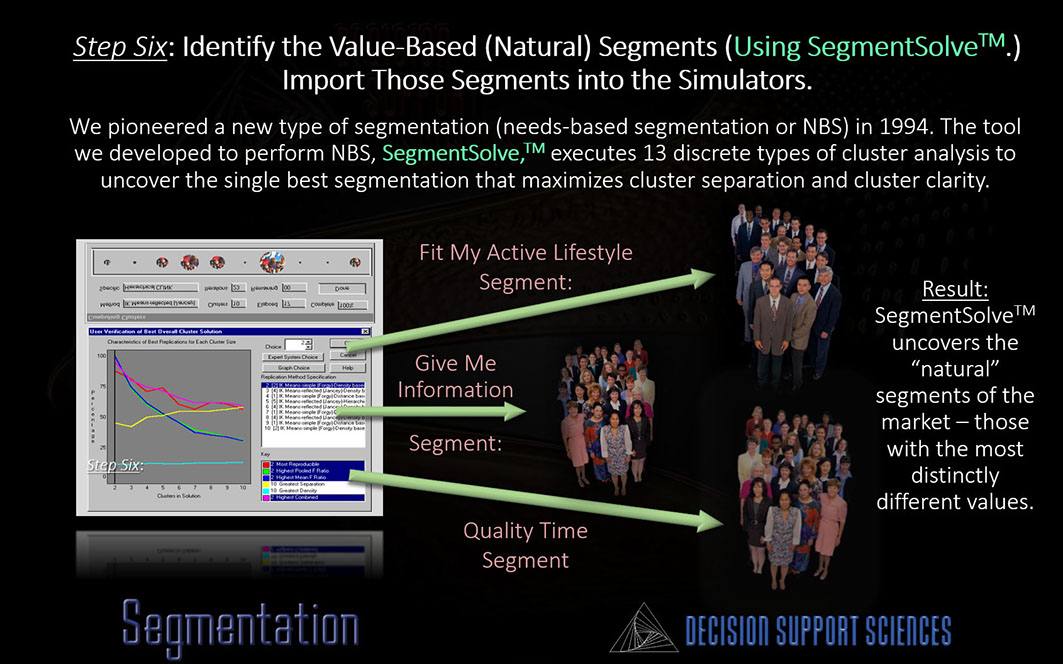

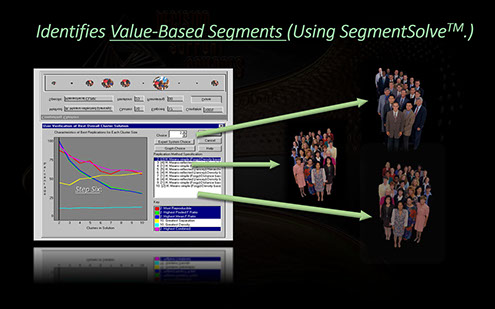

Segmentation uncovers the combinations of key drivers that are most attractive to consumers. The problem? Conventional "one-size-fits-all" segmentation tends to produce sub-optimal segments. To develop the most actionable segments requires a true segmentation decision support tool, one that: 1) executes multi-algorithmic clustering 2) identifies best solutions using expert systems 3) makes recommendations and 4) allows the user to redefine the parameters that define "best." All these features (and more) are built into our advanced segmentation decision support software, SegmentSolve.™

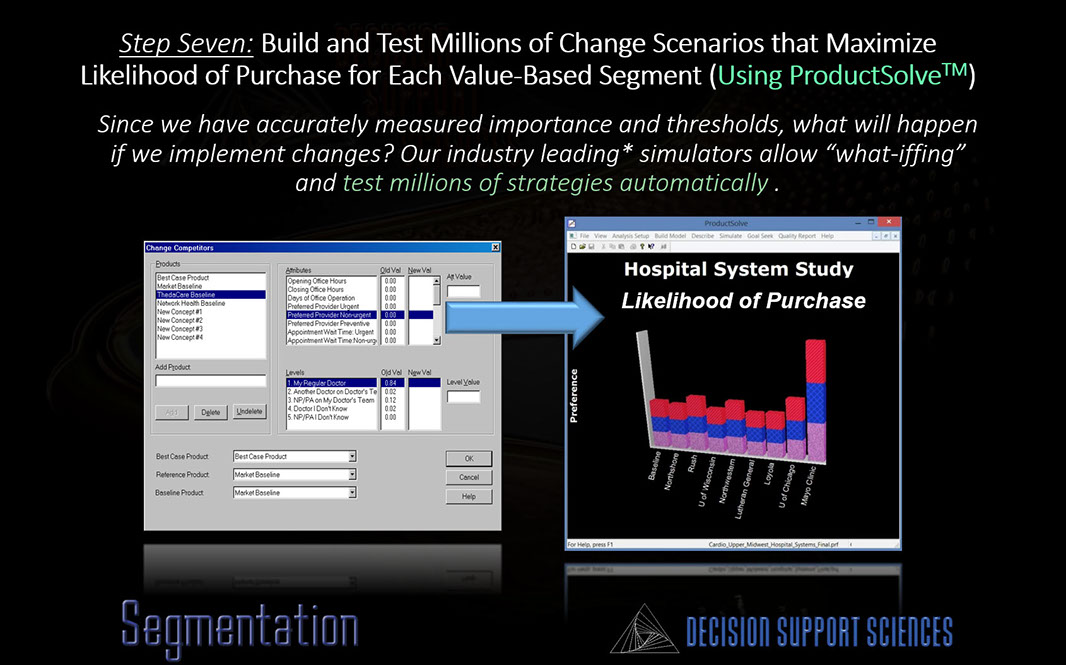

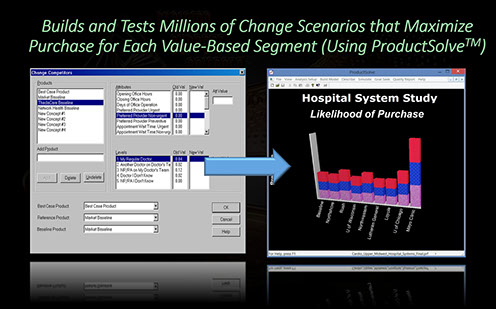

Once the best segments have been uncovered, we import them into our product and service decision support tool, ProductSolve™. Quite importantly, these tools contain threshold data...data that identifies how much change is required to bring a consumer over a real-world threshold (purchase, up-sell, cross-sell, etc.)

Developing 1) value-based segments and 2) importing them into ProductSolve™ allows us to identify which specific existing or new products or services will be most attractive to each segment. One of the most powerful real-world outcomes built into ProductSolve™ is the likelihood of purchase (LOP) simulator. LOP simulation (coupled with imported value-based segments) provides the most powerful current insight delivery platform for capturing new customers within each and every segment.

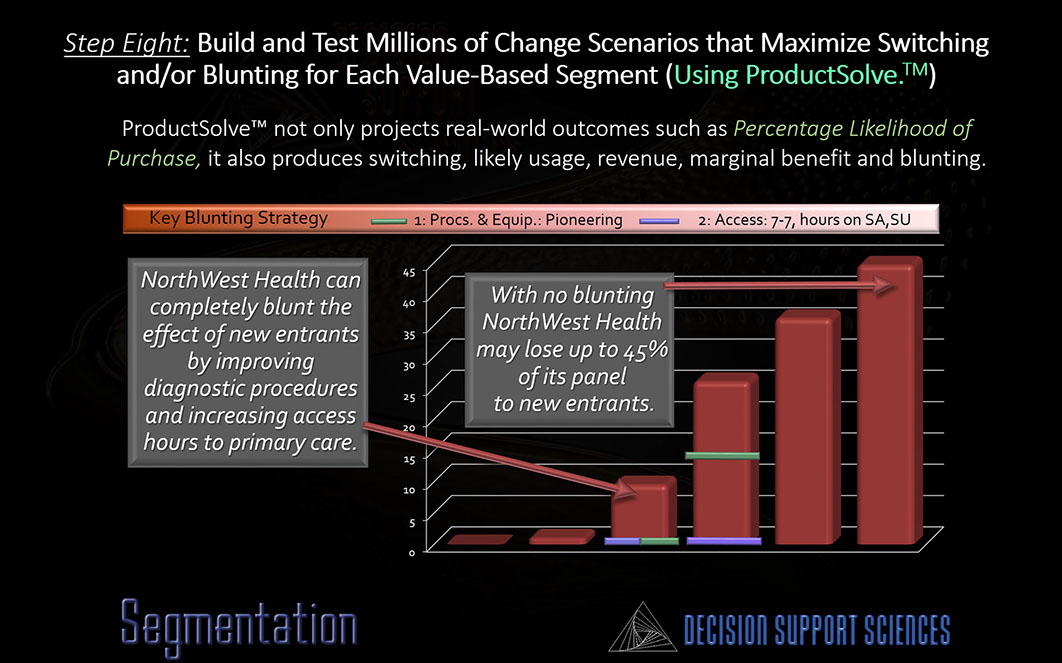

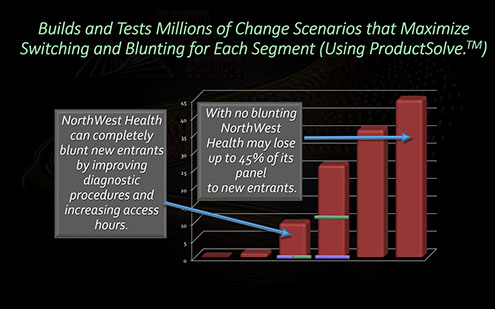

Two of the most powerful real-world outcomes built into ProductSolve™ are switching and blunting. Switching simulation identifies the product configurations that will maximize switching to your product or brand. Blunting, in contrast, identifies how the strategist can protect any product from competitive attrition. By importing the value-based segments developed by SegmentSolve™ into ProductSolve™ these outcomes can be extended to every relevant segment in the market..

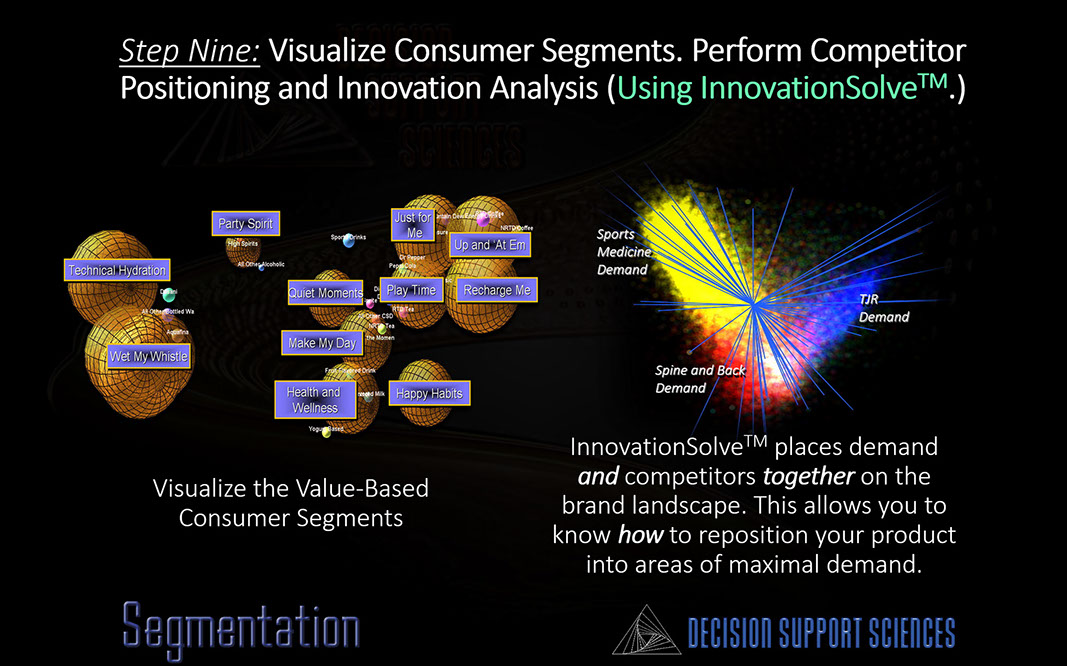

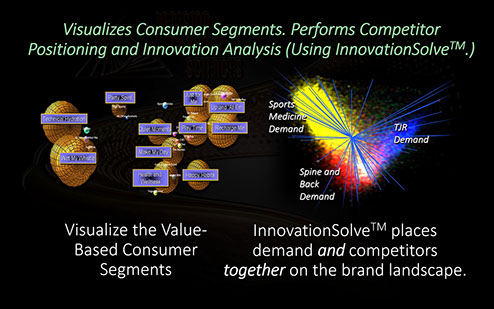

One of the most powerful advantages to developing value-based segments within a framework of decision support is that previously separate decision support outcomes can now be integrated. An example? InnovationSolve™, our innovation decisioning platform can accurately locate both brands and demand on the same landscape. This means that we can now import each value-based segment into InnovationSolve™ and perform Segment-Specific Innovation (SSI).

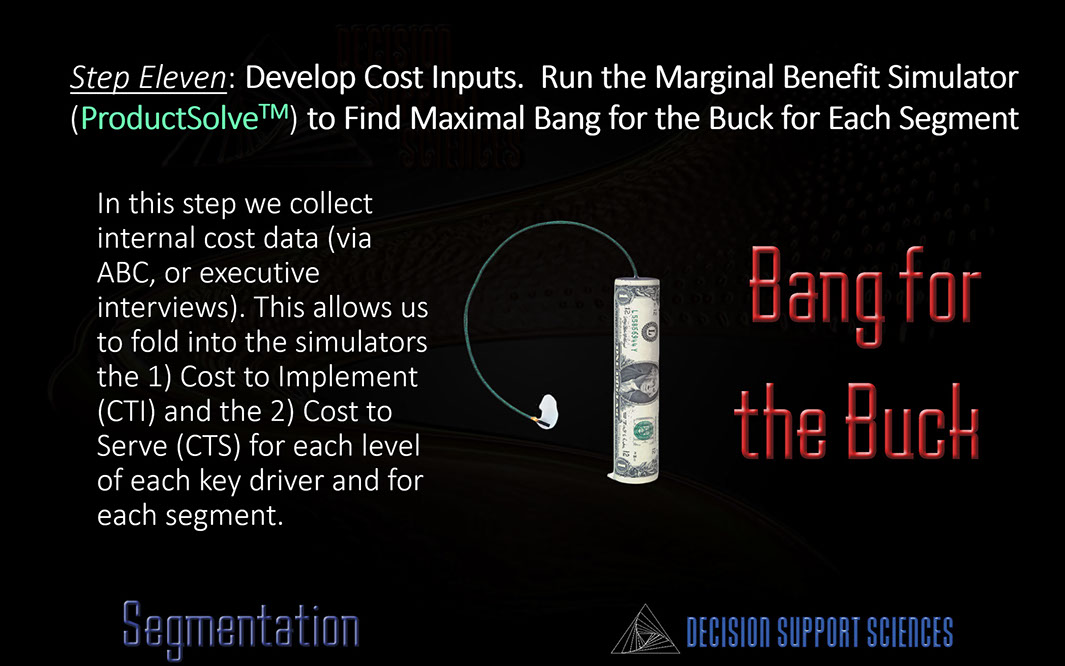

One of most powerful capabilities build into our Product Design protocol is the ability to perform Marginal Benefit (MB) Modeling. The MB model combines a real world outcome model (e.g. new customer capture, likelihood of purchase, switching, retention, etc) with two types of cost data, cost to implement (CTI) and cost to serve (CTS) data. By using CTI and CTS, the Marginal Benefit Model finds strategies that maximize real world outcomes at the lowest cost. When value-based segments are imported into the MB model, we can uncover the best "bang for the buck" for each segment.

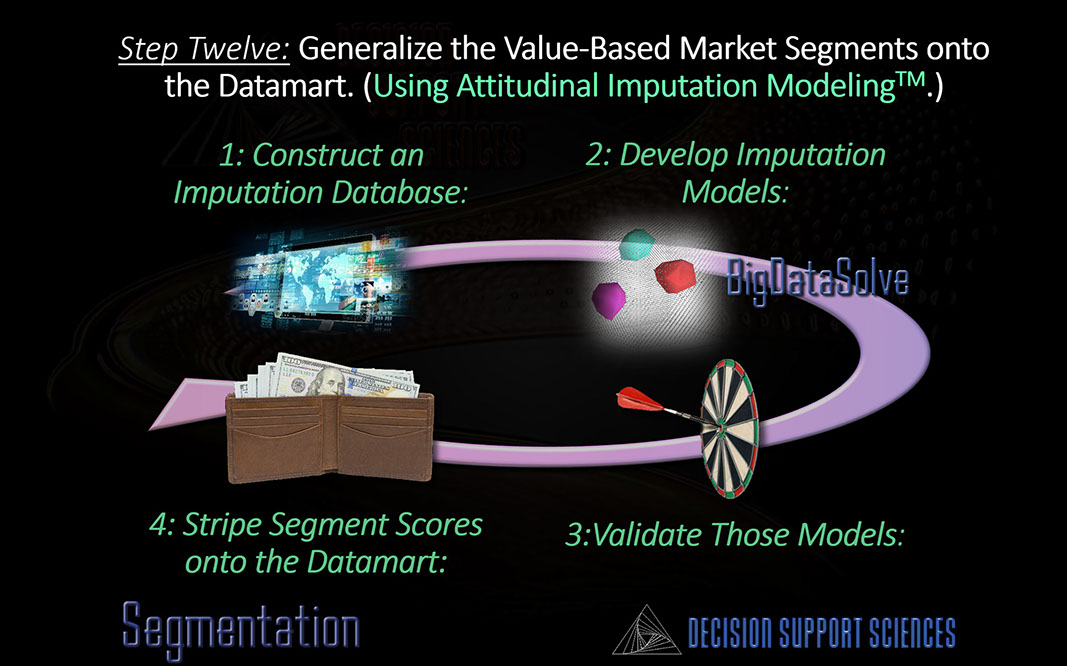

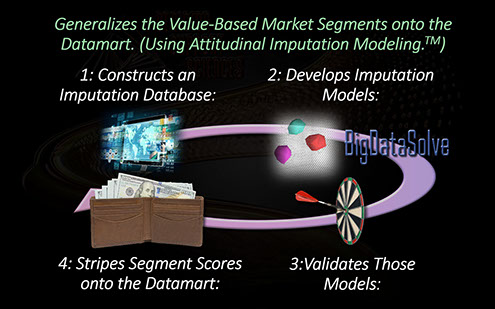

The strategic capabilities of our segmentation practice are competitively unparalleled (maximizing purchase, maximizing switching, and maximizing competitive blunting for each segment.) But there is still something missing....tactics. Since the central decisioning platform for tactical market deployment and sales capture is the datamart (or cloud server) how do we get the power of value-based segmentation onto the datamart? The answer is our datamart enhancement vertical, and its Attitudinal Imputation Modeling (AIM) protocol. AIM uses multivariate imputation to generalize the segments developed from the survey segments onto every record in the datamart.

Solves the Limitation of Conventional Market Segmentation

Captures Underlying Segmentation Values

Solves for the KEY Segmentation Drivers

Identifies True, Value-Based Segments

Ensures Linkage to Real-World Outcomes

Maximizes Purchase for Each Segment

Maximizes Switching & Blunting for Each Segment

Performs Innovation for Each Segment

Finds the Maximum Bang for the Buck for Each Segment

Adds the Segments to the Datamart CORRECTLY

<

>

SegmentSolve™:

EXAMPLE CLIENTS

Retail Financial Services

We have deployed over 20 national segmentation studies for many of the the largest U.S. and Canadian banks.

Retail and Other Financial

We have deployed numerous national segmentation studies for leading retail, mutual fund, investment firm, and trust companies.

Financial Services

Retail and Selected Other Clients

Healthcare

We have deployed over a dozen segmentation studies for large regional healthcare companies.

HealthCare

NEW GENERATION SEGMENTATION WHITEPAPER (PDF)

"Any fool can make things bigger, more complex, and more violent. It takes a touch of genius--and a lot of courage--to move in the opposite direction."

- Albert Einstei

Click here to download the PDF

Download the Segmentation Whitepaper (1MB PDF)