New Customer Capture

CAPTURING 30% MORE PROSPECTS. AT A FAR LOWER COST. REALLY.

(A 2 minute video.)

(Be sure to run the video in fullscreen by clicking on the icons below.)

DOUBLING CAPTURE. AT FAR LOWER COST. IT'S TIME. (INTRO VIDEO.)

THE LIMITATIONS OF CONVENTIONAL APPROACHES

REINVENTING CAPTURE VIA DECISION SUPPORT ENABLEMENT (DSE)

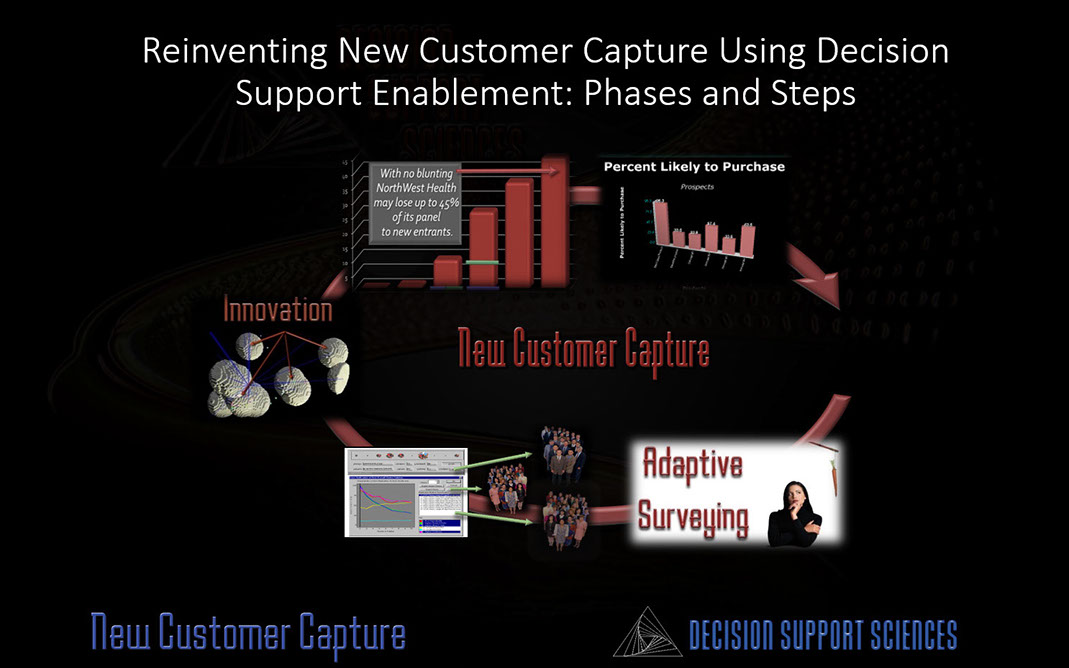

THE PHASES and STEPS OF A DSE CAPTURE ENGAGEMENT

KEY BENEFITS

EXAMPLE CLIENTS

CONTACT / QUESTIONS

VIDEO

CENTER

CONSULTING

PLATFORMS

SOFTWARE

SOLUTIONS BY INDUSTRY

THE LIMITATIONS OF CONVENTIONAL NEW CUSTOMER CAPTURE APPROACHES

Conventional consulting approaches (even current "best practice" approaches) to New Customer Capture demonstrate one or more of the following limitations:

-

The

data

collected is incomplete or inadequate. The measurement system:

- Misses important drivers of new customer capture.

- Does not determine new customer capture thresholds.

- Is not real-world enough to reproduce the actual purchase environment.

- Fails to recognize that very few customers can accurately tell you "how important" key drivers are! But ALL can recognize what is important when they see it.

- Fails to recognize that the average customer highly values only 3-4 key drivers yielding only 25 or so key drivers across all segments - not hundreds of drivers.

-

The

decision support

system:

the tool that "sees and mines" the data:

- Doesn't operate at the level of the individual consumer. This is critical because individuals make decisions - not aggregate markets.

- Is not summative. Doesn't provide enough benefit ("utility") to get consumers "off the dime."

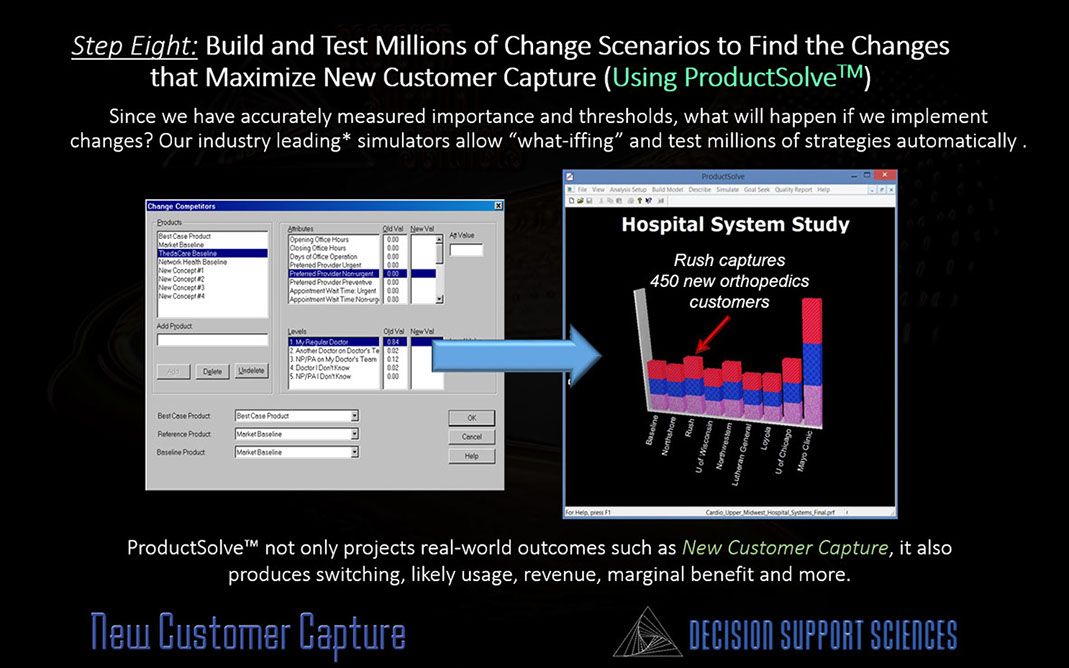

- Doesn't allow "what-iffing" because it hasn't created a true E-customer - an electronic copy of the each representative consumer in the market place.

- Doesn't recognize that building E-customers saves 90% of the survey budget.

- Doesn't automatically test hundreds of millions of viable change strategies.

- Doesn't identify the optimal key driver mix that will capture most new consumers overall.

- Doesn't identify the mix that will capture those consumers at the lowest cost.

- Doesn't place the current product offerings and demand on the same competitive space.

-

The

consulting firm

:

- Imagines that they are your equity partner - and charges you that way.

- Gives you the fish (the answer)...but not the fishing pole (the decision support system).

REINVENTING NEW CUSTOMER CAPTURE USING

DECISION SUPPORT ENABLEMENT (DSE)

What if a Far More Powerful Approach to New Customer Capture Existed? One that:

- Linked to real world outcomes such as: Purchase, Sales/Revenue, Retention and Profit?

-

Retained all the truly useful capabilities of existing best practices such as:

- Accurate real-time isolation of the key drivers for every representative consumer?

- Full inferential analysis of all key drivers (importance, performance, expectation, etc.)

Moreover, What If That Approach Had the Ability to:

- Present any product....in any configuration... to your E-prospects...and identify the product configurations that:

-

- Maximized preference (Preference modeling)

- Caused the maximal number of non-customers to switch to you (Switching modeling)

- Best protected you against competitive attacks (Blunting modeling)

- Maximized market share at the least cost (Price Partial modeling)

- Automatically build and test millions of potential product configurations to achieve these outcomes? Both for the whole market and for every segment?

- Be so turn-key that it could be run by non-experts in-house?

Decision Support-Enabled New Customer Capture achieves all these outcomes and more. The result? Far higher new customer capture...at a far lower cost. Delivered you way. That's enablement.

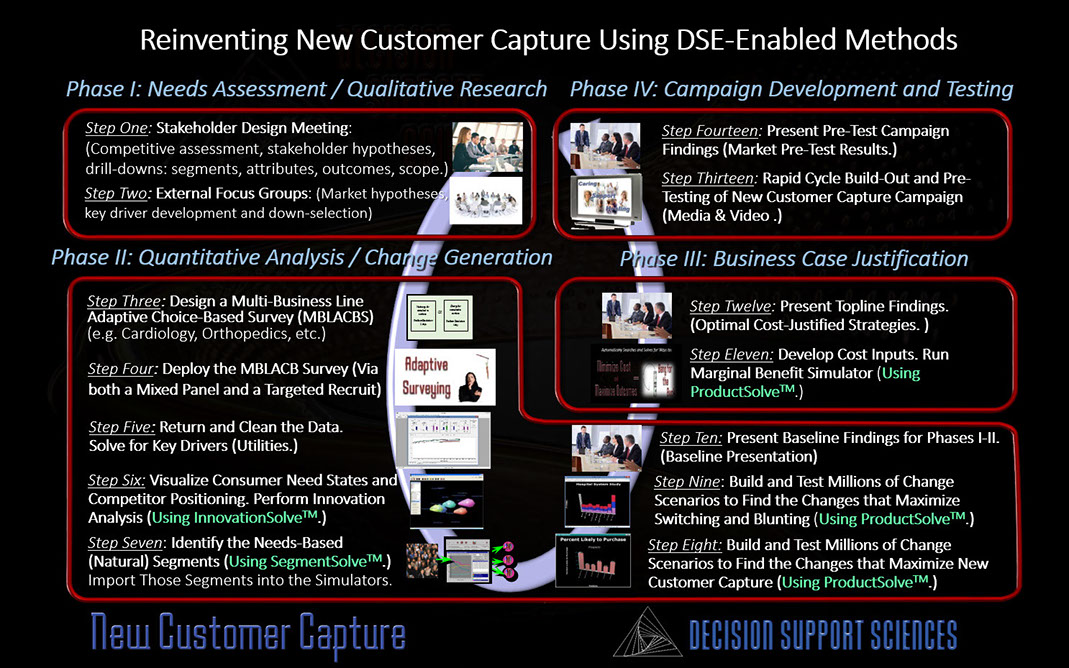

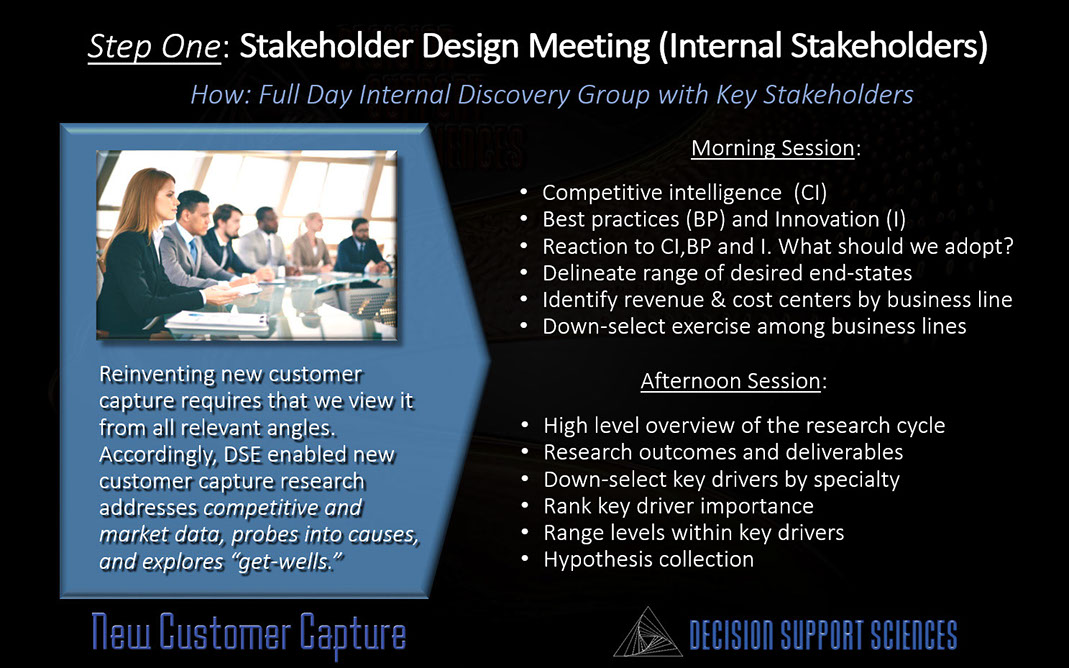

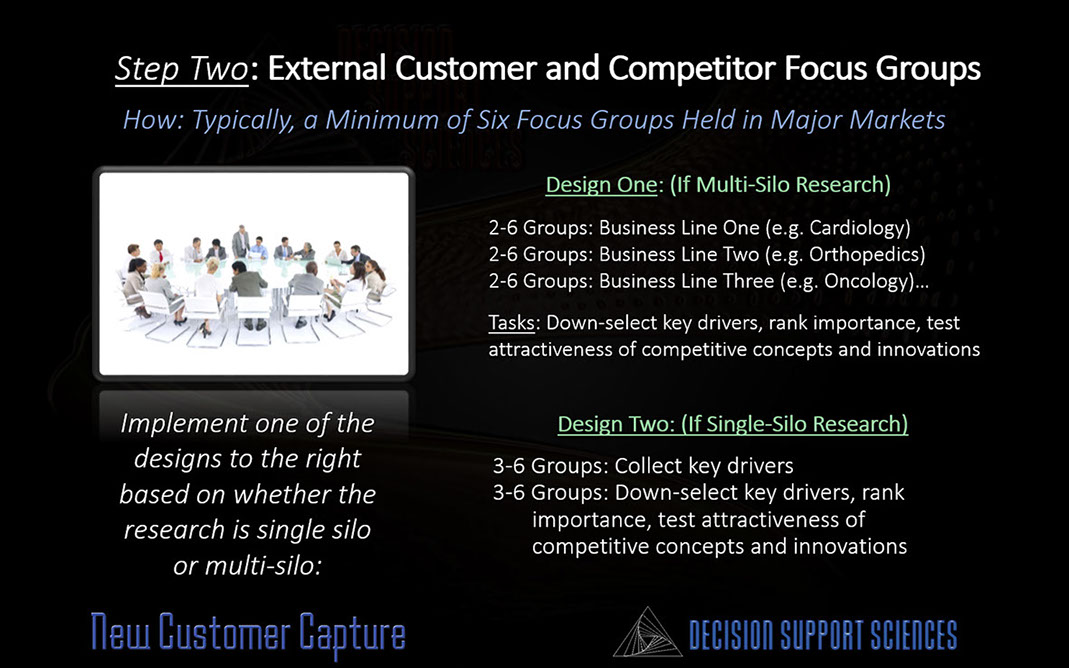

PHASES AND STEPS OF A DSE NEW CUSTOMER CAPTURE ENGAGEMENT

(Click on the first icon below to start the slide show.)

KEY BENEFITS (Place your pointer over the benefits to see the short description.)

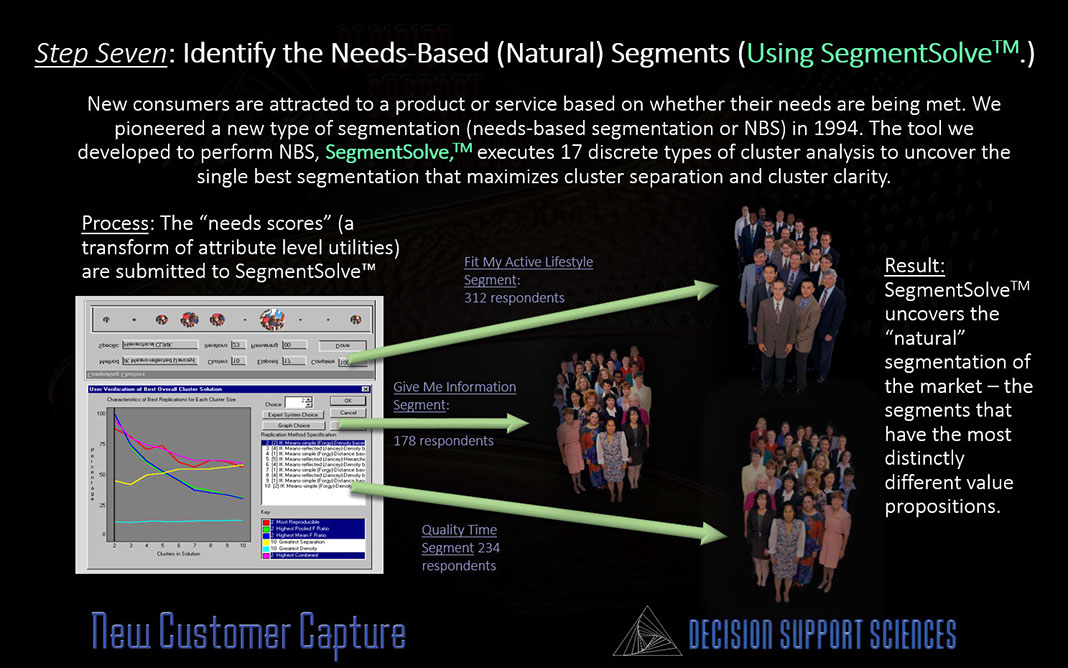

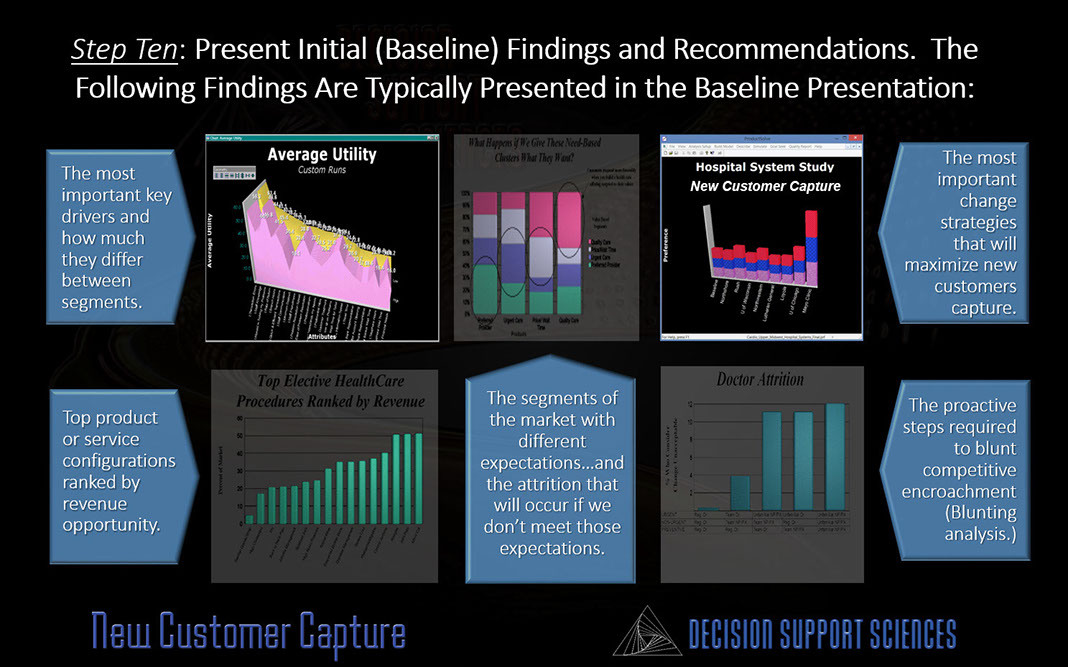

Decision Support-enabled new customer capture markedly outperforms conventional prospecting protocols. This differentiation is due to five key distinctives: 1) NCC uses a specialized survey design that obtains seven key categories of data 2) NCC calculates from that survey ultra accurate importance scores (utilities) for each respondent (see benefit three) 3) NCC obtains key behavioral thresholds that determine how much summed preference are required to get each individual respondent "off the dime" 4) NCC leverages an advanced analysis system that finds all significant differences in importance, performance and expectation 5) NCC uses goal solving simulators that map to real-world outcomes (RWO's).

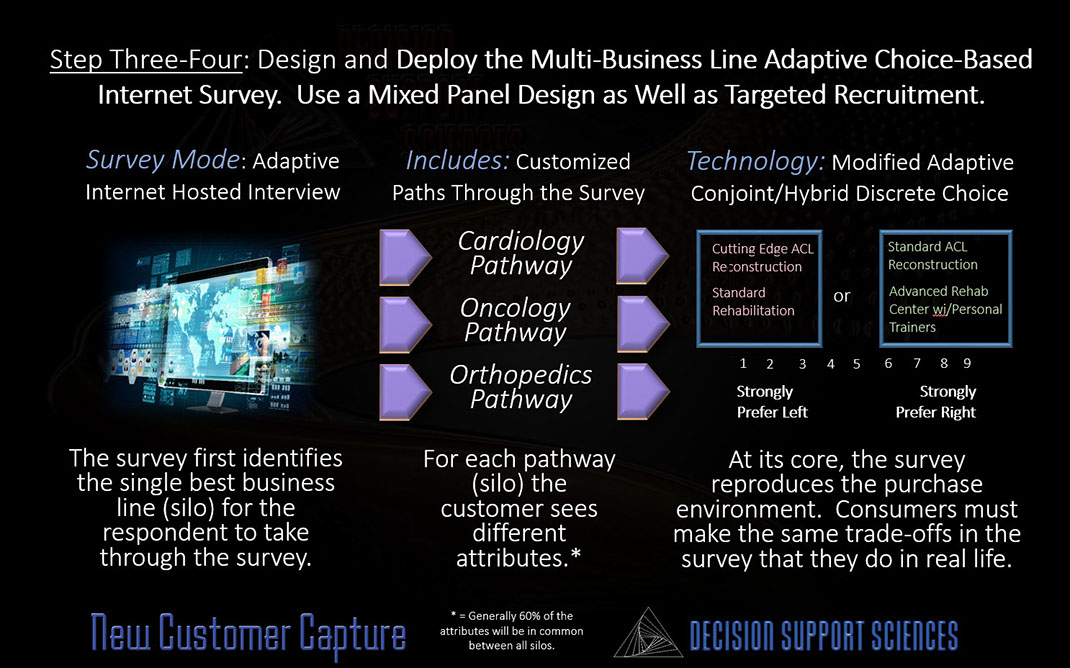

Another primary reasons why our New Customer Capture protocol outperforms other protocols relates directly to our adaptive survey system. Our adaptive surveying approach: 1) eliminates irrelevant attributes for each respondent 2) reproduces the real-world purchase environment 3) requires the respondent to make the same product feature trade-offs in the survey that they must make in real life 4) adapts in real time to prior choices to zero-in on that particular consumer's most critical values and it 5) discovers "how much" preference (summed importance) it takes to meet real-world thresholds (e.g. switching, purchase, etc.)

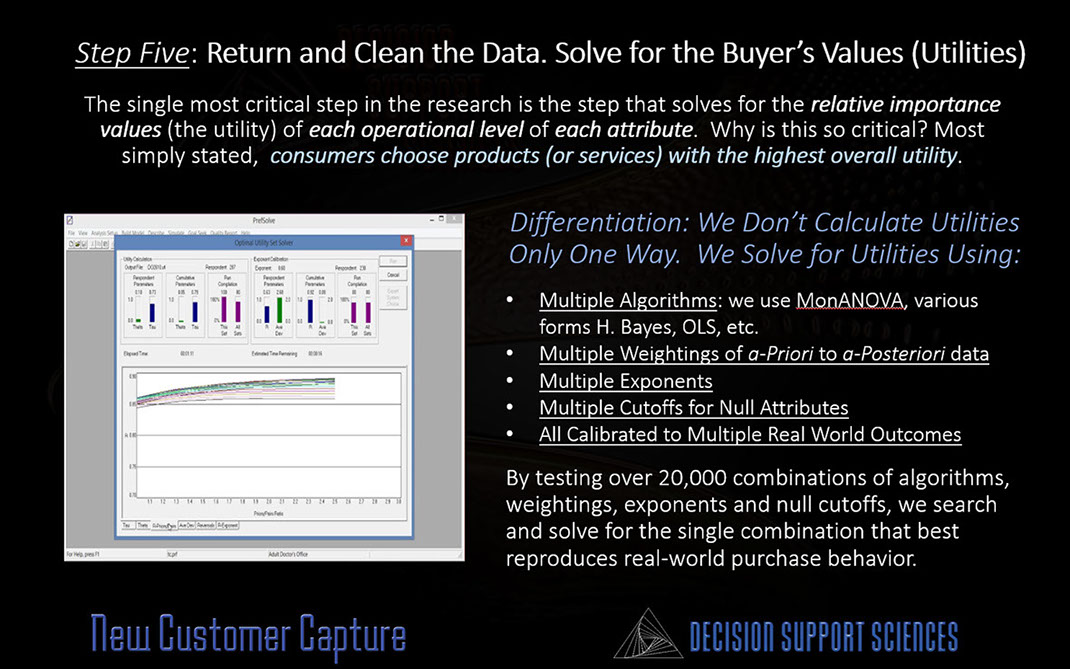

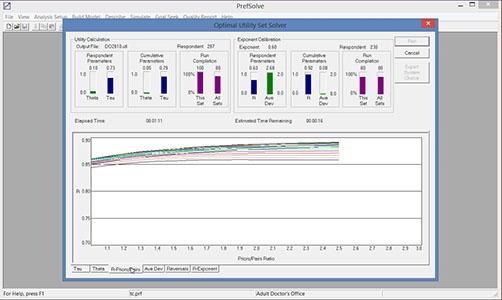

One of the central reasons why our New Customer Capture protocol outperforms other approaches is due to our decisioning platform, ProductSolve™. In contrast to other systems, ProductSolve™ does not use a "canned method" to calculate its utilities. ProductSolve™, in fact, tests over 20,000 distinct combinations of algorithms, weightings, exponents and "TopK" cutoffs. Although this process is computationally intensive, it guarantees that ProductSolve™ empirically converges upon the utility set that best reproduces real-world purchase behavior.

Once we have 1) captured the value system (the importance scores) of each customer and have 2) captured "how much" additional preference is needed to "get consumers off the dime," then, in effect we have created an electronic copy of the customer: an E-customer. The advantage of an E-customer? E-customers respond as original customers do except they never get tired...and never need to be paid! When E-customers are placed inside market simulators they allow us to test millions of potential products per day. The result? More comprehensive risk-mitigation while lowering marketing spend.

The correct theory is necessary, of course, but in the final analysis commercial decision support platforms must predict real world outcomes (RWO's.) ProductSolve™, our core decision support system for new customer capture, leads the industry in predicting real world outcomes. This reason? First, ProductSolve™ produces the most accurate respondent-level importance scores (utilities). Second, we use a proprietary approach to finding behavioral thresholds in the survey. Third, we exhaustively calibrate to real-world outcomes using both internal and external calibration techniques.

It has never been enough to just guess at an outcome.! Nonetheless, many simulation-based approaches only allow manual "what-iffing." In contrast, truly thorough risk-mitigation requires goal-solving. The goal solving built into ProductSolve™ is called Multi-Attribute Simulation Scanning or MASS. MASS automatically builds and tests millions of products to find the subset that produces critical real world outcomes (RWO's) such as maximal new customer capture, switching, etc.

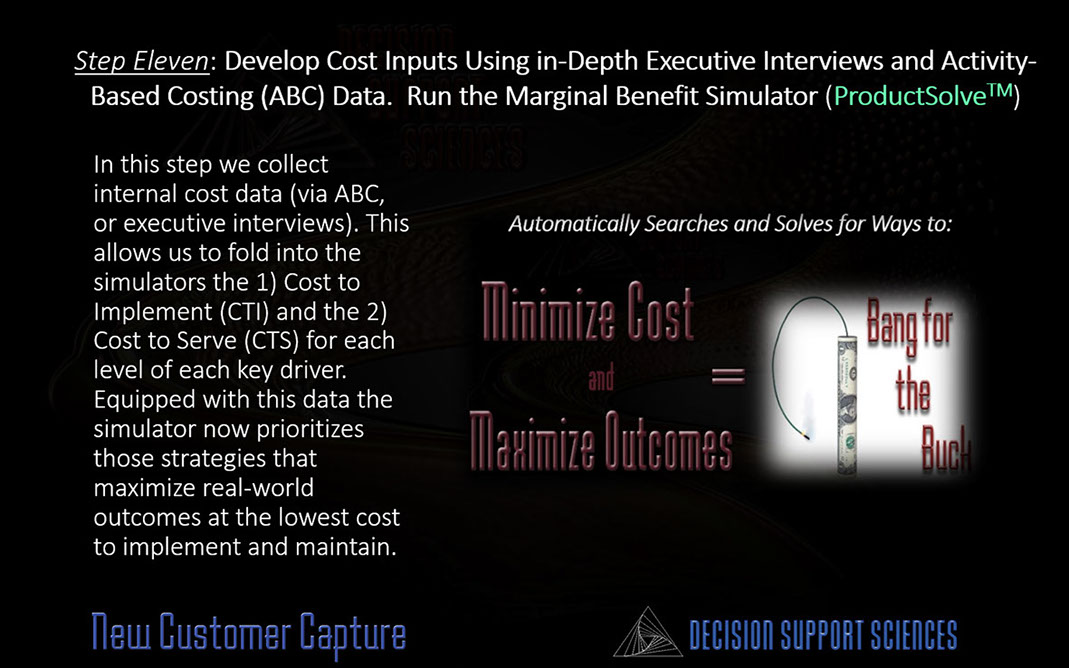

One of most powerful capabilities build into our New Customer Capture protocol is the ability to perform Marginal Benefit (MB) Modeling. The MB model combines a real world outcome model (e.g. new customer capture, switching, retention, etc) with two types of cost data, cost to implement (CTI) and cost to serve (CTS) data. By using CTI and CTS, the Marginal Benefit Model finds strategies that maximize real world outcomes at the lowest cost. The MB model, quite literally, searches and solves for the changes to your product or service that will yield the maximal "bang for the buck."

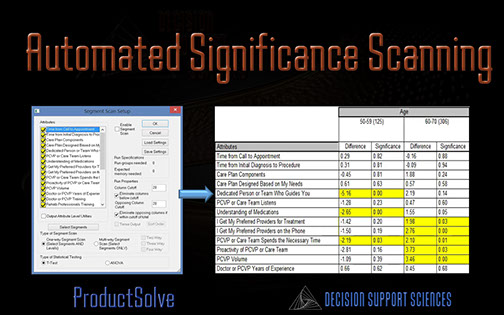

Most marketers are aware that, not infrequently, the entire profit model from a product or service may arise from only one or two market segments. Accordingly, the decision support platform for New Customer capture, ProductSolve™ has the capability to automatically set up and scan for 1) significant analytical findings (e.g. importance, performance, expectation, etc.) and 2) optimal products across hundreds or thousands of market segments. The latter capability can be combined with goal-solving to automatically search and solve for product configurations within segments of customers that will produce optimal real world outcomes (RWO) for your product or service.

One of the most powerful features of our New Customer Capture protocol is ProductSolve™'s ability to search and solve for things we would normally never think of. It does this by automatically scanning any type of data (performance, importance expectation) and finding statistical differences between known or derived market segments. This remarkable capability, computer-aided significance scanning (CASS), finds natural breaks in the data that a) directly translate to new product ideas and b) provides insights into previously undiscovered market segments.

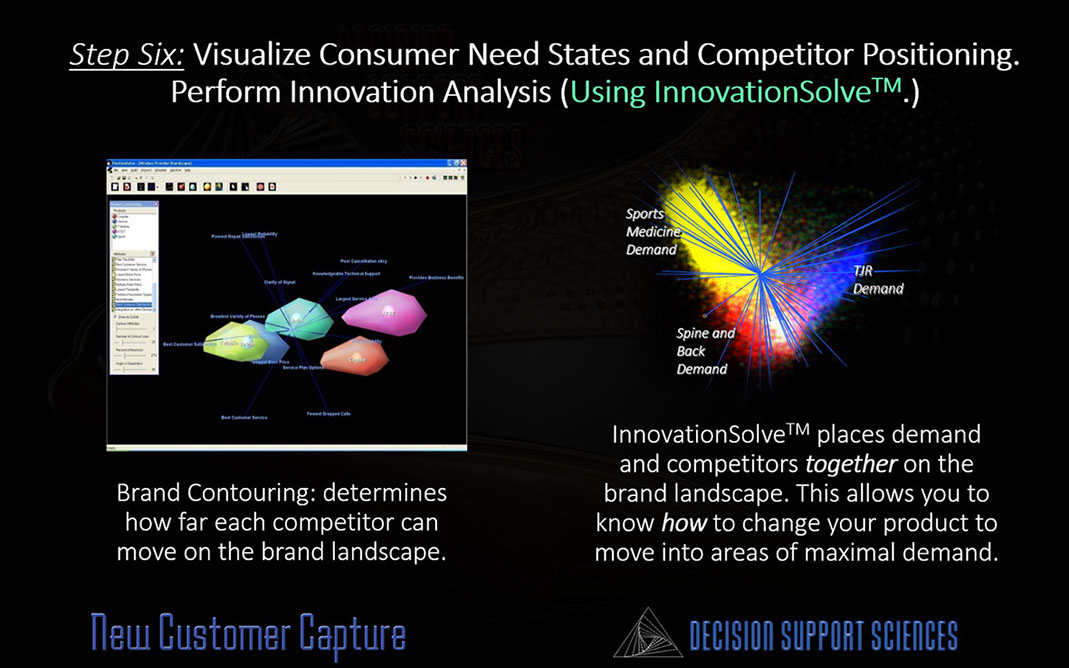

Unlike other approaches to new customer capture, we don't rely on utility-based simulation models alone to risk-mitigate change. We use another complementary approach, as well, multivariate data reduction via InnovationSolve™. InnovationSolve™ accurately locates both brands and demand on the same landscape, a concept so insightful that it earned a main stage presentation at AMA's prestigious Annual Advanced Research Technique forum. Why? Simple! Demand is the missing link in most strategy systems. Demand (seen here as semi-transparent spheres) identifies where to build new products and HOW to message that innovation.

Accurately Develops New Customer Capture Strategies

Reproduces the Real World Purchase Environment via an Adaptive Survey

Yields the Most Accurate Drivers Using Hybrid Advanced Mathematics

Builds E-Customers...the Asset That Lies at the Heart of NCC Strategies

Produces Real World Outcomes

Implements Goal Solving

Identifies Changes That Maximize Profit at Minimum Cost (Marginal Benefit)

Identifies Optimal Segment Strategies

Mines All Significant Differences for All Market Measures Automatically

Performs Innovation Analysis (Moves into Areas of Maximal Market Demand)

<

>

EXAMPLE CLIENTS

Retail Banking

We have deployed over 20 national new customer capture studies for five of the top 20 U.S. and Canadian banks.

Other Financial

We have deployed many national new customer capture studies for leading mutual fund, investment firm, and trust companies.

Retail Banking

Other Financial Services

Healthcare

We have deployed over a dozen new customer capture studies for large regional Healthcare companies.

Other Industries

We have deployed many national new customer capture studies for leading retail firms both nationally and internationally.

Healthcare

Retail and Selected Other Clients